Put Your Money To Work

- 8% preferred interest, and 50% profit sharing over 10%.

- Quarterly distributions of profits.

- Investors paid first before any ongoing management fee.

- Starting investment as low as $50,000.

- Hands off, passive cash flow.

- Investments secured by real estate in competitive markets.

- Backed by a dedicated team in the USA - no phone tree or offshore call centers.

BSTN Fund One invests in private mortgages on business purpose residential and commercial properties across the United States. The property provides the security and collateral for the loan, and cash is generated via monthly loan payments. If a loan defaults, the property is sold at market value. Investors are protected by the inherent value of the real estate, and the safety margin built into each loan - usually 25% or more.

Get Started Today

We make getting started easy. Contact us to get the full offering documentation and answer any questions you may have.

Fund Highlights

UNLOCK THE POWER OF YOUR SAVINGS THROUGH REAL ESTATE

- The Fund targets competitive, risk-adjusted returns for accredited investors by making short-term loans secured by in-demand real estate.

- The underwriting process focuses on the economics of the underlying property securing the loan in addition to the borrower, which minimizes default risk and ensures a loan is self-supported.

- Distributions are investor-first, meaning the investors get paid first before the manager takes a fee, aligning management’s incentives with those of the investor.

- Investors are protected by the value in the property, secured with a first-position mortgage note and deed of trust to the real property against which the loan is valued.

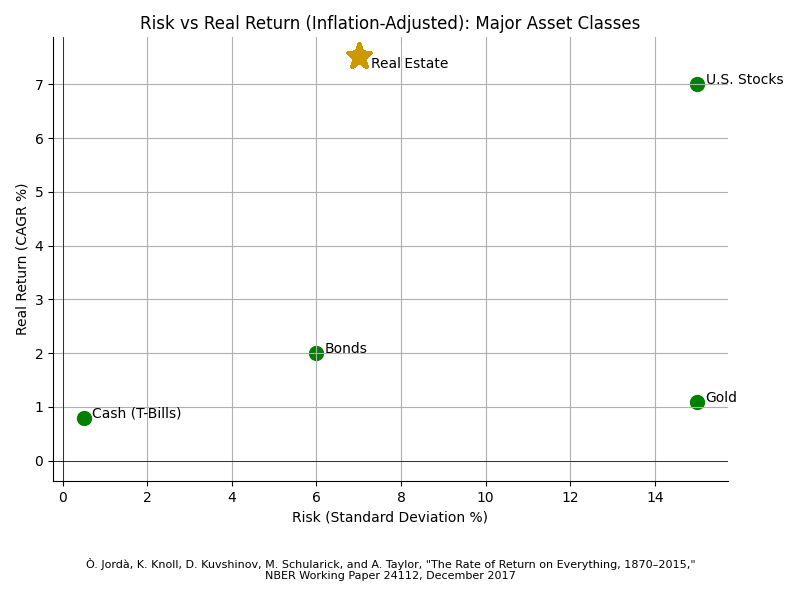

- Real estate provides a proven hedge against inflation and can help stabilize an equity-based portfolio while maintaining competitive returns. 1

- “Perhaps the most surprising finding is that total real returns on residential real estate are on a par with the returns to equities—on average about 7 percent per annum—but they are far less volatile.” 2

- Membership Interests are offered exclusively to accredited investors as defined by the Securities and Exchange Commission in Rule 501(a) of Regulation D.

2. The Rate of Return on Everything. National Bureau of Economic Research, 1/4/2019. https://www.nber.org/reporter/2018number4/rate-return-everything

FAQ

Is this fund a safe investment?

Every investment has risk. We work hard to control that risk by investing in high quality hard money loans that are secured by real property - a.k.a., land and what is built on it. Land cannot be lost or easily stolen, and will always have value, which generally increases over time. Also, the loans we offer are generally no more than 75% loan-to-value, meaning there is a 25% buffer against the value of the collateral. The buffer protects against market fluctuations and makes it easier to quickly recover our capital if things don't go to plan.

How is this different than buying a property? Is this a REIT?

When you purchase a property or invest in an equity fund, you take on all of the risk of the property in exchange for a share of the profit. BSTN Fund One invests hard money loans, a type of private mortgage, so collectively with other investors you are loaning money to a borrower in exchange for an interest payment. We facilitate this process by selecting quality loans, performing the necessary due diligence, and ensuring the investors receive their share of the proceeds, making the process hands-off for you. This is different from direct real estate investing because you do not purchase or sell property directly, and the security interest in the property is simply insurance against the possibility of default.

The Fund is not a REIT, which is a special kind of real estate investment vehicle with its own pros and cons.

What is a hard money loan?

Hard money loans are a type of private loan backed by a "hard" asset, usually real estate, and therefore may also be referred to as a private mortgage. They are much more flexible than standard mortgages, and can help fill gaps for situations that don’t “fit,” such as like flipping a home, repairing or stabilizing a commercial property, or working around credit issues or a prior bankruptcy. Much like a mortgage, they use real estate as collateral, and have specific timeframe, interest rates, and an application and approval process. However, unlike mortgages, hard money lenders typically won’t lend on a personal home, and hard money loans often mature in 6 to 24 months instead of 15 to 30 years.

Are hard money loans the same as private loans or bridge loans?

Hard money loans are a type of private loan backed by a "hard" asset, usually real estate. The most common hard money loans are to renovate homes, or to provide working capital while a person or company negotiates a more traditional loan, which is commonly known as a "bridge loan." However, hard money loans come in a variety of shapes and sizes and serve a variety of purposes. The key element is the focus on the property's value as collateral.

Why not get a traditional loan or mortgage?

Mortgages and loans from large, traditional institutions like banks are heavily regulated, take a long time to setup, and are designed to be paid off slowly over a long period of time. There are very specific parameters for what properties banks will mortgage and who can qualify. Hard money loans are intended to fill the gap around traditional loans. They are ideal for established borrowers seeking a short-term loan for a specific purpose, especially when they need to be flexible or move quickly.

Why are the interest rates higher than what banks are offering?

Interest rates are higher because of the nature of the loan and the process involved. Unlike banks or other traditional lending institutions, hard money loans involve a simplified due-diligence process (because the asset matters more than the borrower) and are for much shorter terms than the traditional 15 or 30 year loans. Borrowers are willing to pay more for the relatively quick access to money, short terms, and flexibility in prepayment. The Fund passes those returns on to our investors.

What is LTV? What do First and Second position mean?

LTV stands for Loan To Value, which is a percentage of a property’s fair market value, or what it can currently be sold for. To illustrate, if a borrower wanted a loan and had a property worth $100,000, then a 75% LTV loan would be for $75,000, using the full $100,000 property as collateral. First position or second position refer to the order of lienholders against a particular property, if there is more than one lien against the property. In other words, a creditor who would get paid first if a property was sold is in the first position, and a creditor who gets paid only after that first creditor has been paid in full is in the second position. In general, the Fund invests in loans with first position liens of less than 75% LTV.

How long does each loan last? What happens when a loan is paid off?

Most loans last between 6 and 24 months, but that can vary with each offering and can usually be extended or paid off early. When a loan is paid off, the principle is returned to the Fund and we roll it into a new loan. We handle all of this for you.

What happens if the borrower stops paying or defaults?

If the borrower stops paying or defaults, we will handle the entire foreclosure process on the real property to recover the principal, plus interest and any expenses. Once the Fund takes possession of the property, we may choose to complete the project, sell as-is, or invest additional capital to maximize the return. A property going through default may impact cash flow in the short term, but if handled properly will often result in an even higher return because of default interest and the LTV buffer built into each loan. Again, we handle all of this for you.

How does this fund compare to the stock market?

BSTN Fund One targets stable returns and cash flow by investing in debt secured by real estate. The Fund is only open to accredited investors, requires a higher initial investment than stocks, and is not liquid - meaning it is a long-term investment. Hard money loans can be a great way to diversify a portfolio, and to hedge against inflation. The Fund is also ideal for investors who need to unlock cash flow from their portfolio for retirement, to start a business, or to cover monthly payments.

Is there a minimum investment amount? A maximum?

Because of the process to verify an accredited investor, the minimum investment amount is generally $50,000, though we can make exceptions. As long as the fund is open there is no maximum amount on individual investments, and once you are a member you can add additional capital in any amount.

How do I fund the investment? How will I receive payments?

Investing is relatively simple. First, you confirm that you meet the requirements of an accredited investor so we can send you the full offering paperwork. Second, once you have reviewed everything, we will help guide you through submitting the needed subscription agreement, evidence of accreditation, and other necessary paperwork. Third, we provide wire instructions so you can fund your investment. Once everything is confirmed, we deploy your money and you become a full member of the Fund, earning interest as of that date.

Getting paid is even easier, and we take care of almost everything. Each quarter you will receive a statement with the fund performance and your share of the interest. You can choose to automatically reinvest the returns, or have them electronically deposited into your designated account.

How often do I receive payments?

As an investor you will receive 100% of the fund's profits as a quarterly interest payment until you have reached the Preferred Return rate - we don't get paid until you make money. Beyond that, additional profits are shared. See the offering documents for the full details.

What if I want to withdraw my investment?

In general, membership in BSTN Fund One should be considered illiquid, especially for the first year. Beyond that, we will work with you to cash out your position as funds are available, usually as new members join or loans pay off. Please reach out to us as early as possible, we are always available to help.

How can I get started?